Welcome to Lee Reed Insurance News Articles

Local: (813) 782-5502

Toll-Free: (877) 205-2824

Identity Theft: A Gift That Keeps On Getting

Shoppers are out in full force this time of year, and so are identity thieves. The holiday season gives credit cards a workout, and with your personal credit information in festive display, identity thieves have more opportunity to feast on your finances.

.

Identity theft and cyber crimes are on the rise. The Javelin Strategy & Research 2013 Identity Fraud Report found that more than 12 million Americans were victimized by ID theft in 2012, a million more than in 2011. The 2012 figure was the second highest number in the 10 years Javelin has been issuing these reports. With mobile transactions becoming everyday habits, there are more opportunities to inadvertently allow access to personal financial data. If you conduct business via mobile apps in public places, you must stay vigilant. The larger your mobile device, the easier it is for someone to look over your shoulder as you enter credit card numbers and your home’s billing address. Be careful out there!

..

Most home and renter insurance policies provide coverage for theft of money or CONTINUE

Extreme weather and short-term memory

We had a bout of cold weather in Florida, and we’re over it – already. Temperatures are back up into the high 70s. This is exactly the kind of “winter” that we love. However, weather extremes come and go, and because we don’t miss them much when they’re gone, we fail to prepare for them and fail to understand them.

.

A science writer for the Associated Press wrote an article suggesting Americans are becoming weather wimps. Severe cold weather has become less frequent as the world warms, so when bitter cold spell hits, people think it’s unprecedented – even when it’s not. Until 1997, cold extremes happened every four years. With the world warming, cold extremes happen less frequently. Conversely, warm extremes are far more common. CONTINUE

..

Three of the top 10 locations for wettest climates are in Florida. CONTINUE

Article found on PropertyCasualty360's website @ http://www.propertycasualty360

IIHS: Car Crashes Decrease Among Senior Drivers

results found that fatal crash involvement fell 36% for drivers aged 70-74; 46% for drivers 75-79; and 49% for drivers 80 and older from 1997 to 2012.

Older drivers today are less likely to be involved in car crashes than prior generations, according to a study from the Insurance Institute for Highway Safety. The findings support a continuing trend that began in the mid-1990s and help to quell fears of aging baby boomers becoming a safety and insurance threat on the road. According to the study, from 1997 to 2012, fatal crash rates per licensed driver fell 42% for older drivers and 30% for middle-aged drivers. Breaking it down by age group, study

Article found on PropertyCasualty360's website @ http://www.propertycasualty360

Fla. Hit-and-Runs Increase 8%

believes there could be a correlation between those findings and the fact that one in four drivers in Florida aren’t insured, says the Herald. CONTINUE LEARN MORE

A lack of auto insurance may be fueling an epidemic of hit-and-run occurrences in Fla., according to the Bradenton Herald.

.

The Florida Highway Patrol (FHP) reports there were 78,000 hit-and-run crashes in the state in 2013—an 8% increase from 2012. These crashes involve people leaving the scene of an accident causing injury or property damage, says the Herald. These incidents caused more than 17,000 injuries and 154 deaths, according to the FHP.

.

Lynne McChristian of the Insurance Information Institute

Definition of sanity means repeating hurricane season prep

.Article by Lynne McChristian. Florida representative for the Insurance Information Institute. www.iii.org

It’s Hurricane Season, and here’s the drill:

- Newspapers print their hurricane guides.

- TV stations develop specials on preparedness.

- County emergency managers host hurricane expos.

- The director of the National Hurricane Center says Floridians are not well prepared.

Blah, blah, blah. Every year, it’s the same thing, and most people react by doing…..nothing. Until the last minute, of course, when a storm is barreling down too close to home, and there’s that crazy, mad rush to the grocery store..CONTINUE

.Article by Lynne McChristian. Florida representative for the Insurance Information Institute. www.iii.org

.Article by Lynne McChristian. Florida representative for the Insurance Information Institute. www.iii.org

The right insurance keeps your boat afloat

Living in Florida means boating season never ends. With the right insurance protection, your boating days can be as carefree as a day at the beach. The type of insurance coverage you get depends upon the boat.

.

If you have a small boat, such as a canoe or kayak, you may have coverage under your homeowners or renters insurance policy. Coverage is usually about $1,000 or 10 percent of the home’s insured value. That amount of coverage includes the small boat, motor and anything you may use to tow it. It does not typically include liability insurance...CONTINUE

.Article by Lynne McChristian. Florida representative for the Insurance Information Institute. www.iii.org

Do older cars need collision coverage?

Article by Lynne McChristian. Florida representative for the Insurance Information Institute. insuringflorida.org.

Let’s say the new-car smell wore off years ago, and the air freshener mimicking the scent can’t hide the stinky fact that your car’s best years are in the rearview mirror. You’ve always had full coverage, and that made sense then – but does it make sense now? Like so many things in life, the answer to that question is: It depends.

...

Your insurance company will only pay what your car is worth in today’s market. The decision on whether to keep comprehensive and collision coverage depends upon the car’s value. So, you have to do the math. A general guideline is that when auto CONTINUE

The stinks on you without sewer back-up coverage

This type of damage is typically excluded from a standard homeowners policy; it requires a separate endorsement.

It’s not a pretty picture to have a toilet backup. Not pretty at all, especially if the backup spills past the bathroom, down the hallway for several feet and seeps over your hardwood floors. What’s even uglier is finding out you neglected to buy sewer backup coverage.

There are two types of insurance for ground water damage, and they require either separate coverage or an endorsement to your policy. One is flood insurance, and the other is water backup or overflow from sump pumps. There are probably CONTINUE

Article by Lynne McChristian. Florida representative for the Insurance Information Institute. insuringflorida.org.

Even if you don’t live anywhere near a pond, lake or the ocean, you can get water backing up into your house.

Here's Why Your Car Insurance Rates Keep Going Up

The average collision claim ran $2,950, over $1,300 more than the average comprehensive claim at $1,585. CONTINUE

Automobile crashes exact a high price when it comes to the loss of human life and injuries.

Article found on PropertyCasualty360's website @ http://www.propertycasualty360

Globally, nearly 1.3 million individuals are killed in crashes each year, which averages out to 3,287 deaths a day according to the Association for Safe International Road Travel. In the U.S., the NHTSA says that 33,561 people were killed in auto accidents in 2012, and 2.3 million were injured, although crash fatalities have steadily decreased since then.

The average auto liability claim for property damage was $3,073 in 2012, while the average bodily injury claim was $14,653, according to the Auto Injury Insurance Claims Study.

Article by Lynne McChristian. Florida representative for the Insurance Information Institute. http://www.insuringflorida.org.

Foiling identity theft during the holidays and all year through

- Dumpster Diving: Thieves aren’t above digging through your trash to get check information, credit card numbers or bank statements. They also look for pre-approved credit card offers you may have received, so tear those up before tossing them CONTINUE

Our state ranks highest, based on complaints per population. And, Florida is behind only California for cyber crime.

Since the holidays seem to stimulate use of credit cards, galvanize your fraud awareness radar right alongside. Be aware of tricks of the identity theft trade, particularly:

- Shoulder Surfing: This is when someone is watching over your shoulder in a public place as you punch in a credit card number or listening in while you call in a credit card order over the phone. Seek privacy!

Guess which state had the highest number of identity theft complaints last year. Yeah, it’s Florida.

The umbrella advantage.

- You’re protected no matter where you are - even when you’re out of the country.

- You’re covered for any wages lost due to a court appearance, up to the limits specified in your PUP.

- Insurance company will retain and pay for your attorney if you’re sued over an incident covered by your PUP.

..

CALL LEE REED INSURANCE AT 813-782-5502 FOR MORE DETAILS OR A QUOTE

In today’s world, lawsuits are common and if you’re ever found at fault in a major auto accident, a serious mishap on your property or an accident halfway around the world, it’s a real possibility you will be sued.

An umbrella policy offers an extra layer of protection over and above your standard auto or homeowners insurance. In short, a PUP kicks in when your liability limits have been reached.

Personal Umbrella Policy Insurance

PUP kicks in when your liability limits have been reached.

You are required to have car insurance if you are going to be driving an automobile. Picking the right plan is often difficult. The amount of options available can overwhelm even the best of us.

"Dropping the Collision/Comprehensive coverage after four or five years should be sufficient." Dropping physical damage coverage is a tactic often advocated in consumer articles about how to save money on car insurance. The reality is that this is often a very bad idea.

For example, I have a 4 year old Honda Odyssey. Keeping the calculations simple, the KBB value is $13K - $16K. My annual physical damage premium is $233. If I drop that coverage, my car is totaled the next day, and I would like another identical vehicle, I'm out $13K - $16K. If I dropped my $233 annual premium and put that money CONTINUE

How to Save $233 on Car Insurance and Incur a Loss Exposure of $16,000

CALL LEE REED INSURANCE

AT 813-782-5502

FOR MORE DETAILS OR A QUOTE

Article found on Independent Insurance Agents and Brokers of America, Inc. @ http://www.independentagent.com Author: Bill Wilson

Article found on PropertyCasualty360's

website @ http://www.propertycasualty360 By Patricia L. Harman

Heavy spring rains, a sudden thunderstorm or melting snow from the mountains hundreds of miles away can be enough to cause rising water and flooding in the most unexpected places.

The Midwest frequently experiences river flooding, the Northeast can suffer Nor’easters and spring melting, and the West Coast frequently has flooding from November through March. A flash flood can bring a wall of water anywhere from 10 to 20 feet high. A few inches of water from a flood can CONTINUE

5 things you should know about flood insurance.

Floods are No. 1 disaster in U.S.

Over the past 50 years, every state has experienced flooding or some sort of flash flood. This means that as a homeowner or renter, you don’t have to live near a body of water to be exposed to the dangers of flooding.

CALL LEE REED INSURANCE

AT 813-782-5502 FOR A QUOTE

Ridesharing services, or transportation network companies (TNCs), are everywhere. Uber alone signs up an estimated 20,000 drivers each month worldwide. The service is particularly popular with millennials who appreciate the lower transportation costs and how easy it is to use the app from their phones.

You have a nice car and could use extra cash. You sign up to be a driver, install the app and soon you are driving people around and making money. Is it too good to be true?

..

Not if you consider these five factors before driving into the passenger service frenzy. CONTINUE

5 things drivers need to know before

working for a ridesharing service.

The ads are enticing: “Make $35/hour driving with us!” or “You could make $800 a week or more!”.

Article found on PropertyCasualty360's

website @ http://www.propertycasualty360 By Galen Hayes

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian June 23, 2015

Rainy season is here, and parts of Florida know it all too well as some areas experienced heavy rainfall in the past 24 hours – with more on the way, almost daily. And, that reminds me that my flood insurance premium is due. Renewing flood insurance coverage should be a no-brainer for those living anywhere near a body of water.

For me, it is a full-brainer, as each year I reconsider my decision – because I can. I have a so-called Preferred Risk Policy (PRP), meaning my property is at low risk for flood damage so the mortgage company doesn’t require flood insurance. But because I also know all too well that 20 percent of flood insurance claims come from low- to moderate-risk flood zones, I will renew. A recent trip to assess Houston’s flood damage reinforces this decision.

Flood Insurance Premiums

Article found on Insuring Florida's website @ www.insuringflorida.org. By Lynne McChristian June 23, 2015

Every day, on average, there are more than 700 traffic crashes on Florida roadways, according to the crash facts report by the Dept. of Highway Safety & Motor Vehicles. About 8 percent of those crashes involve teen drivers.

Drivers between the ages of 15-19 naturally have less experience. But teen drivers also tend to think they are experts at multitasking, which is an incredibly dumb thing to believe while driving.

The National Highway Safety Administration has a “5 to Drive” campaign that provides parents with reminders of rules of the road ripe for frequent reinforcement: CONTINUE

Teen Driver Safety Week: Don’t touch that phone

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian June 23, 2015

Are you cleverer than a cyber crook?

With the Holiday Season Upon Us - Be Aware

A plastic foam superhero action figure saved me yesterday. She flew into my mailbox, along with a pamphlet extorting, “Be a Cyber Hero.” And, I am (cue Superman theme song).

I got an email yesterday purportedly from a newspaper reporter. In the subject line, it said “View Document,” and there was a graphic of the document to click upon. The email even had the reporter’s correct email address, signature line and phone number. I did not click it – because it’s Cyber Security Awareness Month – and a foam action figure warned of danger ahead.

There is identity theft insurance. Some insurers offer it as part of a standard homeowners or renters policy; others provide the protection through a separate policy. Since cyber theft is a growing threat, this coverage is worth considering, as is remaining diligent toward suspicious emails. LEARN MORE

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian October 30, 2014. LINK

Steeling seniors against scams & shams

Seniors get mounds of unsolicited mail for all types of investment “deals” and requests for iffy charitable donations..

There always seems to be someone trying to get rich quick at the expense of the unsuspecting. Insurance fraud is a $32 billion business for property/casualty insurers, and the U.S. Dept. of Health and Human Services estimates healthcare fraud to be more than twice that amount. While there are many fraud victim stories to tell, it’s kind of scary when one hits close to home.

I was reminded of the vulnerability of senior citizens yesterday as I cleared a pile of papers from my desk to see a letter an 81-year-old relative received months ago telling her she won a “Shoppers Sweepstakes.” Along with the letter declaring her “winning” $230,000 was a very legitimate-looking check for $3,750. The letter explained the money CONTINUE

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian January 27, 2016. LINK

Assignment of Benefits: A sign of a scam?

Signing over your insurance claim means you’ve agreed to step away and let a stranger handle things.

They make it sound so simple. You have a sudden water leak in your house. You call a plumber who makes an emergency repair. He tells you there is water damage because it was a sneaky leak that went undetected for long enough to mess with pipes or cabinets or kitchen tile – or the balance of the cosmos. “Let me call my buddy,” he says. “He handles the dry-out process so you won’t have more troubles. Sign this form that transfers your insurance claim, we’ll get you a lawyer to work with your insurance company. Don’t

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian March 3, 2016. LINK

FLORIDA HOMEOWNERS PAY HIGHEST PROPERTY INSURANCE PREMIUMS BECAUSE STATE STILL OWNS #1 POSITION FOR DISASTERS

Here’s a question we get every year: Why does Florida have the most expensive homeowners insurance in the nation?

The answer is easy: It is the riskiest state to write homeowners insurance.

The average Florida homeowners policy cost $2,115 in 2013, according to a report released last week by the National Association of Insurance Commissioners. That’s highest in the land. Texas is No. 2 ($1,837), and Louisiana is No. 3 ($1,822). We have a ranking of the states at the Insurance Information Institute web site.

Florida’s premium rose about 1.5 percent from a year earlier. The increase is easy to explain. The cost of insuring a home is, of course, affected by the cost of repairing that home when it is damaged, and that rises just about every year, thanks to inflation. But how did the price get so high in the first CONTINUE

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian March 3, 2016. LINK

CHEAPER GAS FUELS MORE DRIVING, MORE CAR CRASHES, HIGHER AUTO INSURANCE COST.

CHEAPER GAS FUELS MORE CRASHES?

Drivers everywhere continue to enjoy the benefits of low gas prices, and what are they doing to celebrate? They are driving more. It’s less costly to take a road trip now, rather than fly to another destination, so more drivers are taking to the streets. More cars on the road increase the number of traffic crashes which, in turn, translates into higher auto insurance rates.

Insurance rates are the cost of claims – and if the cost of individual claims rises and the number of claims rise, so must insurance to cover those increased costs. In 2012, the Florida Legislature passed reforms to the state’s no-fault auto insurance law, which were intended to CONTINUE

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian. LINK

Got a fire alarm? Put it to the test

Fire Prevention is one of those things you really need to take action on. It’s great if you have fire alarms in your home, but it’s not great if they are inoperable. As the National Fire Protection Association (NFPA) says, “Working fire alarms save lives."

The NFPA has a fire prevention quiz that is enlightening. Okay, I’m giving you the answers to the quiz, but this is a test worthy of a cheat sheet. Did you know that if a smoke alarm fails, it’s likely because of dead batteries or because batteries were not properly installed? Other important lessons: CONTINUE

When was the last time you tested your home’s fire alarm? If you can’t remember, then it’s time to do it. Put your fire alarms to the test today. Please?

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org - By Lynne McChristian. LINK

Get schooled on dog bite liability

Your pets may have pet insurance to keep them healthy. But when it comes to liability for their misdeeds, the financial impact will bite into your wallet.

Every May is Dog Bite Prevention Week, and the American Veterinary Medical Association reminds us that even nice dogs can bite. Dog bites (and other dog-related injuries) accounted for more than one-third of all homeowners insurance liability claim dollars paid out in 2015, costing in excess of $570

LEE REED INSURANCE

AT 813-782-5502

million, according to data from the Insurance Information Institute (I.I.I.) and State Farm®, the largest writer of homeowners insurance in the United States.

.

While the number of dog bite claims nationwide decreased last CONTINUE

Late summer is the peak time for hurricane season. And as if on cue, there’s a few storms brewing out in the Atlantic. It’s too early to tell if they will impact Florida, but it is not too early to prepare as if they are.

Review our hurricane season insurance checklist. First on the list is probably the most important: Make certain to have enough coverage to completely rebuild your home in the event it is severely damaged or destroyed. This means sufficient insurance protection to rebuild your home and replace all its contents.

Don’t confuse the real estate value of your home with its insurance cost. Typically, the older your home the bigger the gap between what it costs CONTINUE

How named storms matter to property insurance

Article found on Insuring Florida's website @ www.insuringflorida.org - By Lynne McChristian. LINK

LEE REED INSURANCE

AT 813-782-5502

Family, friends and festivities should be the focus of the holiday season, but don't let this joyous time be marred by fire, theft, accidents and other disasters, advises the Insurance Information Institute (I.I.I.).

Taking a few simple steps, and having the right insurance coverage can reduce these seasonal hazards. Start with these five safety tips:

1. Be Fire Safe

December is the peak month for fires caused by candles. Christmas tree-related fires, while not as common as candle fires, are much more likely to be deadly. Decorations and cooking are the CONTINUE

Happy--and Safe!--Holidays:

5 Tips For Disaster-Free Festivities

Article found on PR Newswire Association LLC Website. A Cision company. LINK

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org - By Lynne McChristian

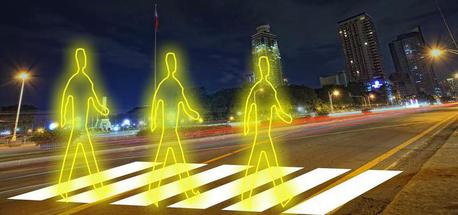

Eight of top 10 most dangerous metros for pedestrians are in Florida # 7 is Tampa - St. Petersburg - Clearwater

Walking is definitely good for your health. But it may be dangerous to your life in busy cities, particularly in Florida. A study by Smart Growth America ranked eight Florida metros in the top 10 after analyzing pedestrian deaths over a 10-year period.

The group created a Pedestrian Danger Index to compare pedestrian safety in cities of different size, density, and rates of walking. So, it’s not only a factor of big cities with more cars and more walking. The study contends it is also due to “poor pedestrian infrastructure,” meaning roads are designed to move cars along with little thought to people traveling on foot. There is an interactive map on the group’s website that pinpoints.

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org - By Lynne McChristian

Where the damage is in water-damage claims

additional contractors and leads to (oftentimes needless) litigation.

The practice has become so prevalent that it has caused an insurance rating agency to declare an “uncertain operating environment” and

What happens when you let a third party handle your insurance claim? The answer, in a symbol, is $. Insurers have been sounding alarms about assignment of benefits for a couple of years now, and the issue is ever more in the spotlight. A recent editorial suggests it is time to bring water damage abuse under control. Here’s what’s been happening: A homeowner with a water damage claim is convinced by a contractor to assign the insurance benefits to him. The contractor stands in the shoes, so to speak, of the insured and deals directly with the insurance company. The problem with that is it can make the claim needlessly more expensive because it links in (sometimes needlessly) additional contractors and leads to (oftentimes needless) litigation. The practice has made the claim needlessly more expensive because it links in (sometimes needlessly)

LEE REED INSURANCE

AT 813-782-5502

Buying Life Insurance

Just the facts on life insurance

When buying insurance, you can be overwhelmed by an information avalanche. To protect your future from poor

choices today, organize your insurance search by reaching back to grade school and employing the use of the 5 W's: Who? What? Where? When? Why? and How much?

Article found on Bankrate.com. By Julie Sturgeon.

LEE REED INSURANCE

AT 813-782-5502

PIP / No-fault future under debate - again

The Florida Legislature is again looking at ending no-fault auto insurance in Florida. Sound familiar? Tweaking no-fault (also known as personal injury protection – PIP) is a frequent topic for legislative debate. CONTINUE

Article found on Insuring Florida's website @ www.insuringflorida.org

By Lynne McChristian

LEE REED INSURANCE

AT 813-782-5502

Article found in Tampa Bay Times www.tampabay.com | A Times Editorial by WILL VRAGOVIC -

LAWMAKERS IGNORE INSURANCE MESS

Assignment of benefits, which can lead to costly court battles, is driving up rates for thousands of homeowners across Florida, and drivers are starting to feel the pinch too.

Florida's badly broken system for filing and settling insurance claims, which is wreaking havoc in the property insurance market, is creeping into auto policies with Tampa Bay at ground zero. Assignment of benefits, which can lead to costly court battles, is driving up rates for thousands of homeowners across Florida, and drivers are starting to feel the pinch too. Lawmakers have done nothing about this mess, so it's up to consumers to be on guard and know what they're signing. CONTINUE

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org - By Lynne McChristian

Longevity, love and life insurance

“I hope the Lord gives us longevity,” said my father as we talked about family, his aches and aging. Dad was already in his early 80s at the time, so that comment struck me in a very profound way. I had two thoughts: First, my dad does not think he is old yet, and that no matter how much time we have on earth, it may not be enough. Thankfully, longevity is a gift to me from both dad and mom, who are in their late 80s now. I am grateful for that plus other revelations, not the least of which is to know that to enjoy this day includes planning for tomorrow. Pops delivered that lesson to me as a teenager. He made me buy a life insurance policy.

LEE REED INSURANCE

AT 813-782-5502

Standard homeowners and renters insurance does not cover flood damage. Flood coverage, however, is available in the form of a separate policy both from the National Flood Insurance Program - NFIP (888-379-9531) and from a few private insurers.

.

The NFIP provides coverage for up to $250,000 for the structure of the home and $100,000 for personal possessions.

.

You will need flood insurance if you live in a designated flood zone. But flooding can also occur in inland areas and away from major rivers. Consider buying a flood insurance policy if your house could be flooded by melting snow, an overflowing creek or

Does My Homeowners Insurance Cover Flooding?

LEE REED INSURANCE

AT 813-782-5502

Flooding has devasted many areas of the United States over the past few years, creating enormous damage to properties and thousands of vehicles.

.

Flood-damaged vehicles offer a tempting opportunity for criminals to defraud unsuspecting consumers.

.

Carfax research recently revealed Americans are driving more than a quarter-million flood damaged cars. Carfax estimates that more than 50 percent of water-damaged cars get resold.

.

Fraud involving used vehicles damaged by storm flooding that later appear in used car lots and auction sales is common, CONTINUE

How to avoid becoming a victim of 'flood vehicle' fraud

Article found on Property Casualty 360 website @ http://www.propertycasualty360.com - By Ayleen R. Heft. LINK

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida's website @ www.insuringflorida.org - By Lynne McChristian

Autonomy Getting Closer: Consumers Learning to Trust New Auto Safety Features.

Car shoppers are more ready for autonomous vehicles than they may realize, according to a report from car shopping platform Edmunds.com. More than 60 percent of new vehicle models today can be purchased with some level or autonomous features, the report, Transportation Transformation, shows.

Whereas today more than 60 percent of new vehicle models can be equipped with what are called Level 1 or Level 2 autonomy, as defined by the Society of Automotive Engineers, less than a quarter of new vehicle models offered these features just five years ago. “While there are a number of ways one can define who’s ‘leading’ in the race to CONTINUE

LEE REED INSURANCE

AT 813-782-5502

Article found on Insuring Florida @ www.insuringflorida.org. By Lynne McChristian

Social host liability means party not too hearty

What is “social host liability”?

It’s holiday party time, and if you are the party host, your responsibility extends beyond figuring out what appetizers to serve with the wine and beer. There is something called “social host liability,” which means at a party where alcohol is served, the hosts are responsible for making sure guests can safely drive home.

There are different legal obligations in each state. In Florida, hosts are generally not responsible for their guests’ behavior. However, if alcoholic beverages are provided to anyone under age 21, and the underage person becomes intoxicated and injures a third party, the host

LEE REED INSURANCE

AT 813-782-5502

- You study safety and performance ratings before buying a car.

- You have your prospective home professionally inspected from basement to roof.

- You read labels and select the best foods for your family’s table.

Why should insurance purchases

be any different?

Yet even the most conscientious consumer may balk at the complexity of this purchase and just take a shot in the dark, by going with a company whose name sounds familiar.

Shine some light on the subject as you search for the best insurance for your needs by examining these myths about insurance.

Myth #1: All insurance companies are basically alike.

Truth #1: Insurance companies vary in the financial strength that backs your policy, assuring they can meet their obligations to pay claims. Look for an insurer that. LEARN MORE, CONTINUE

4 Common Myths About Insurance

LEE REED INSURANCE

AT 813-782-5502

Last week, Waymo showed a video of people riding in its self-driving minivans. They thumbed their phones, yawned and one snoozed. The message: Driverless cars are so safe, they’re boring. The clip was meant to drum up support for a fully driverless taxi service it plans in Phoenix later this year.

Now, a tragedy may slow the Alphabet Inc. unit’s efforts, and the broader industry march toward commercialization of this technology. A self-driving test car from Uber Technologies Inc. hit and killed a CONTINUE Driverless Vehicle Makers Reach Feared Crossroad with Uber Fatality

Driverless Vehicle Makers Reach Feared Crossroad with Uber Fatality

LEE REED INSURANCE

AT 813-782-5502